Farm Loans that Pay

-

August 8, 2023

August 8, 2023

Shop for interest rates, fees, and flexibility when looking for your next loan and find a lender who will continue working for you after closing.

As a farmer-owned cooperative, Farm Credit Illinois (FCI) understands every dollar counts. That’s why we offer low upfront rates, flexible loan terms and options, no lender fees* at closing, fee-free repricings, and annual cash patronage to retroactively reduce rates.

Customized & Competitive Loan Terms

Whether you're financing a new land purchase, refinancing a current cattle facility loan, or looking for an operating line of credit, FCI has the products your farm needs to succeed. We provide rate, term, and payment schedule options that correlate with your seasonal cash flows.

“Livestock financing isn’t as clean and tidy as other farm loans, but Farm Credit knows what they’re doing in ag,” says Jared Schilling, Illinois grain and livestock farmer. “Farm Credit is part of the team – the family farm has a vision of where we want to go, and they help us get there.”

“Livestock farms are ever-changing so keeping track of all the moving parts takes extra attention and communication,” states Laura DuFrenne, FCI loan officer. “We have a specialized credit team dedicated to customizing loan terms for livestock borrowers, getting them closer to their next goal.”

Patronage Lowers Interest Rates Further

FCI annually returns a portion of our net earnings to borrowers through cash patronage. The cooperative model means we are motivated to maximize the value cooperative members receive, not profits for investors like other financial institutions.

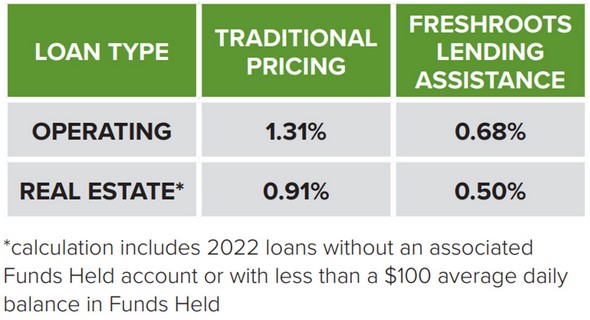

The cooperative distributed $40 million in June 2023, representing 43.4% of 2022 net earnings. This lowered the effective interest rate of 90% of members’ 2022 loans by at least:

Our rates compete with other financial institutions throughout central and southern Illinois – making the effective interest rate reduction delivered by cash patronage even more impactful.

“Farm Credit’s loan terms have always been competitive, and the relationships are great. The cash patronage on top is a nice bonus that has benefitted our farm,” Jared notes.

Members can pencil in patronage annually, even with today’s financial market pressures. You can credit this to the Board of Directors’ long-term capital management plan that prioritizes low upfront interest rates and consistent patronage payouts while managing capital conservatively.

“Our members are our owners. What FCI does well is going to benefit you directly, coming full circle when you calculate cash patronage into your bottom line,” says Laura.

No Lender Fees at Closing

Fees can greatly impact how much you pay for a loan. FCI agricultural loan borrowers* are not charged:

- Origination fees – we do the processing and underwriting, so let us pay for it

- Traditional loan appraisals – our in-house appraisal team delivers complimentary services

- UCC filings – we cover the cost of submitting UCC financing statements with the state

By waiving these fees, cooperative member-borrowers save up to 1.5% of the loan amount. Plus, there’s no penalty if you decide to pay off early.

Fee-free Repricings

When the financial markets cycle and lower interest rates return, most FCI loans are eligible for this money-saving perk at no cost. The Association repriced more than 12,300 loans for combined annualized member savings in excess of $16.3 million from Jan. 2019-June 2022.

As you shop for agricultural financing, consider the cooperative advantage of doing business with Farm Credit Illinois, where we deliver farm loans that pay.

*does not apply to leases or AgDirect equipment or Rural 1st country life loans

-

Tag Cloud

FFA Weather Farm Land Values Dr David Kohl Essentials Newsletter Farm Credit College Calendar contest Financials Weather Outlook 4-H Auction Results appraisals security employees Interest Rates scholarships Community Improvement Grants balance sheet liquidity patronage Education FOMC cash flow land sales rural marketplace investment farmland auctions Focus on Farming calendar Land Classes